Are you tired of the complexities involved in filing your taxes? Look no further! Introducing the Effortless W-4 Form 2024 Printable, an innovative solution designed to simplify your tax filing process. With this user-friendly form, you can say goodbye to the confusion and stress that often accompany tax season. Whether you’re an individual or a business owner, this printable W-4 form will streamline the entire process, making it easier than ever before to accurately report your income and deductions. Get ready to simplify your tax filing with ease and tackle your financial obligations with confidence!

Related Post:

- Demystifying the Annual Changes: The Truth about New W-4 Form Updates”

- Master the Art of Filling Out My W4 Perfectly: Step-by-Step Guide with Expert Advice”

- Optimize Your Tax Savings: Unveiling the Pros and Cons of Claiming 1 or 0!”

- Boost Your Efficiency with W-4 2024 Printable: Save Time and Money!”

- Effortless W-4 Form 2024 Printable: Simplify Tax Filing with Ease!”

Effortless W-4 Form 2024 Printable: Simplify Tax Filing with Ease!

As the tax season approaches, many individuals find themselves overwhelmed with the complexities of filing their taxes. However, with the introduction of the W-4 Form 2024, the process has become much simpler and more efficient. In this article, we will explore the benefits of the W-4 Form 2024 and how it can help individuals simplify their tax filing with ease.

Understanding the W-4 Form 2024

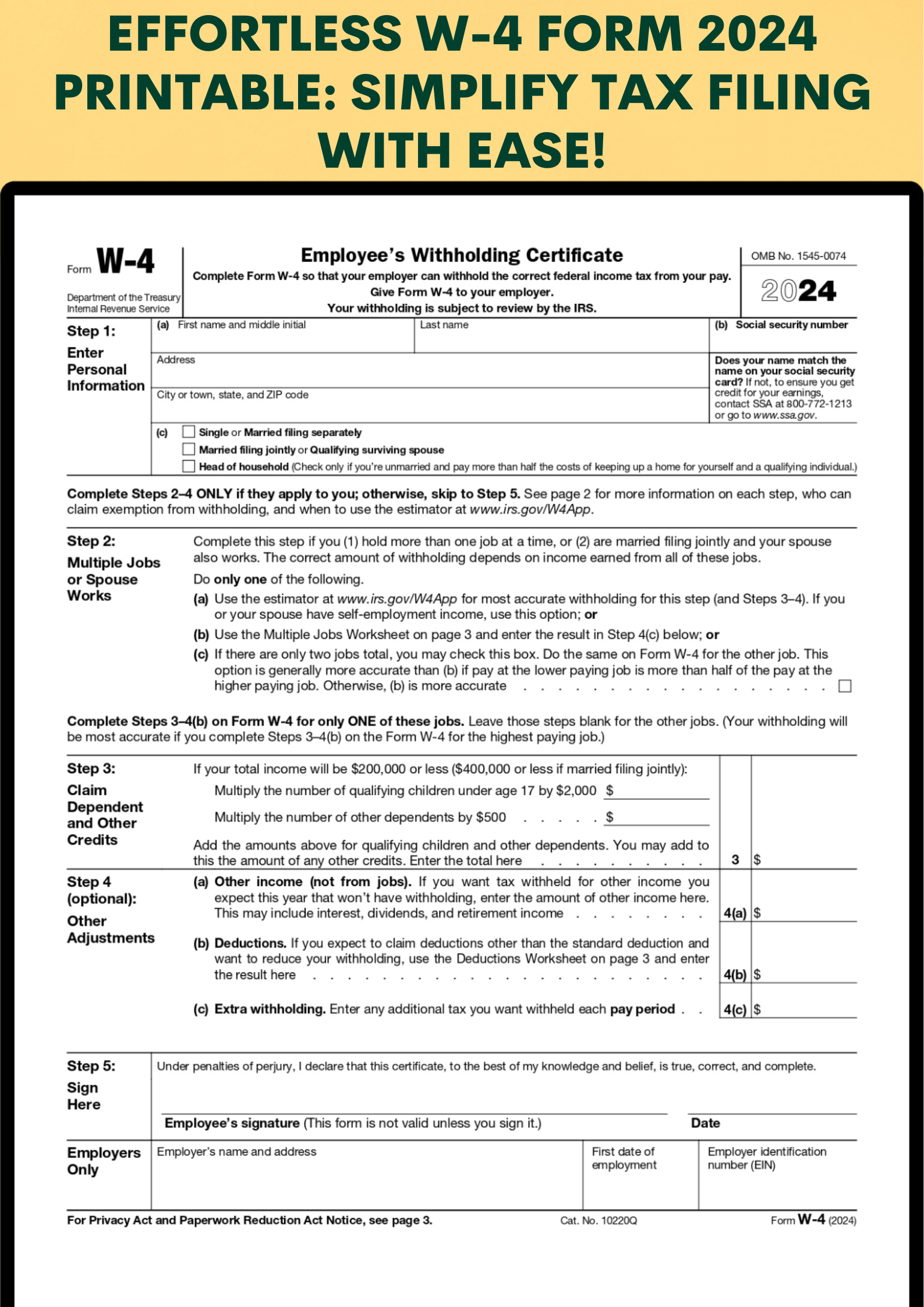

The W-4 Form 2024 is a document that employees in the United States must complete to ensure their employers withhold the correct amount of federal income tax from their paychecks. This form is crucial as it determines the amount of tax that employers will deduct from an employee’s paycheck based on their filing status, dependents, and other relevant factors.

By accurately completing the W-4 Form 2024, individuals can avoid overpaying or underpaying their taxes throughout the year. This ensures that they do not face any surprises when it comes time to file their tax returns.

The Benefits of the W-4 Form 2024

- Simplified Process: The W-4 Form 2024 has been redesigned to make it easier for individuals to navigate and understand. The form includes clear instructions and prompts to help employees accurately fill in the necessary information. This simplification of the form reduces confusion and minimizes errors, ultimately saving individuals time and effort.

- Enhanced Accuracy: The W-4 Form 2024 incorporates changes that improve the accuracy of tax withholding calculations. This means taxpayers are more likely to have the correct amount of tax withheld from their paychecks, reducing the likelihood of owing taxes or receiving a large refund at the end of the year.

- Flexibility: The W-4 Form 2024 allows individuals to choose the filing status and withholding allowances that best reflect their personal circumstances. This flexibility ensures that taxpayers have more control over their tax obligations and can adjust their withholdings as needed throughout the year.

How to Obtain and Fill the W-4 Form 2024

The W-4 Form 2024 is readily available on the Internal Revenue Service (IRS) website. Individuals can easily download and print the form from the IRS website or request a physical copy from their employers. Once obtained, individuals need to carefully read the instructions provided and fill in the required fields accurately.

It is important to note that the W-4 Form 2024 requires individuals to provide information about their filing status, dependents, and any additional income. By ensuring this information is accurate and up to date, individuals can avoid any discrepancies in their tax withholdings.

Conclusion

The W-4 Form 2024 is a powerful tool that simplifies the tax filing process for individuals. By completing this form accurately, individuals can ensure that the correct amount of tax is withheld from their paychecks, reducing the chances of owing taxes or receiving a large refund. The enhanced simplicity and flexibility of the W-4 Form 2024 make it an invaluable resource for individuals looking to simplify their tax filing experience. So, don’t hesitate to utilize this effortless W-4 Form 2024 printable and simplify your tax filing with ease!

Here are W4 Form 2024: