Are you ready to supercharge your tax filing process and take control of your finances? Look no further than the Form W-4 2024 PDF! This powerful tool is designed to help you unleash savings and streamline your financial management. Whether you’re a seasoned taxpayer or just starting out, understanding and utilizing the Form W-4 2024 PDF can make a significant difference in maximizing your tax benefits. In this article, we will explore the key features of this form and provide you with valuable insights on how to best leverage it to your advantage. Get ready to unlock a world of savings and simplify your financial journey!

Related Post:

- 2024 Form W-4: Simplified Guidelines and Smart Strategies for Tax Planning”

- Revolutionary Tax Calculator 2024: Accurate, Efficient, and Empowering!”

- Effortlessly Access W-4 2024 Printable Forms: Simplify Your Taxes with Ease!”

- Boost Your Efficiency with W 4 Form 2024 Printable – Simplify Tax Filing Hassles Now!”

- Maximize Your 2024 Tax Returns with IRS W4 Form Pdf: Unlock Hidden Benefits & Simplify Reporting”

Supercharge Your Tax Filing with Form W-4 2024 PDF: Unleash Savings and Streamline Your Finances!

Tax season can be a daunting time for many individuals and businesses alike. The complexities of filing taxes and ensuring compliance with ever-changing tax laws can leave you feeling overwhelmed. However, with the introduction of the updated Form W-4 for the year 2024, you can supercharge your tax filing experience, unleash savings, and streamline your finances like never before.

Understanding Form W-4

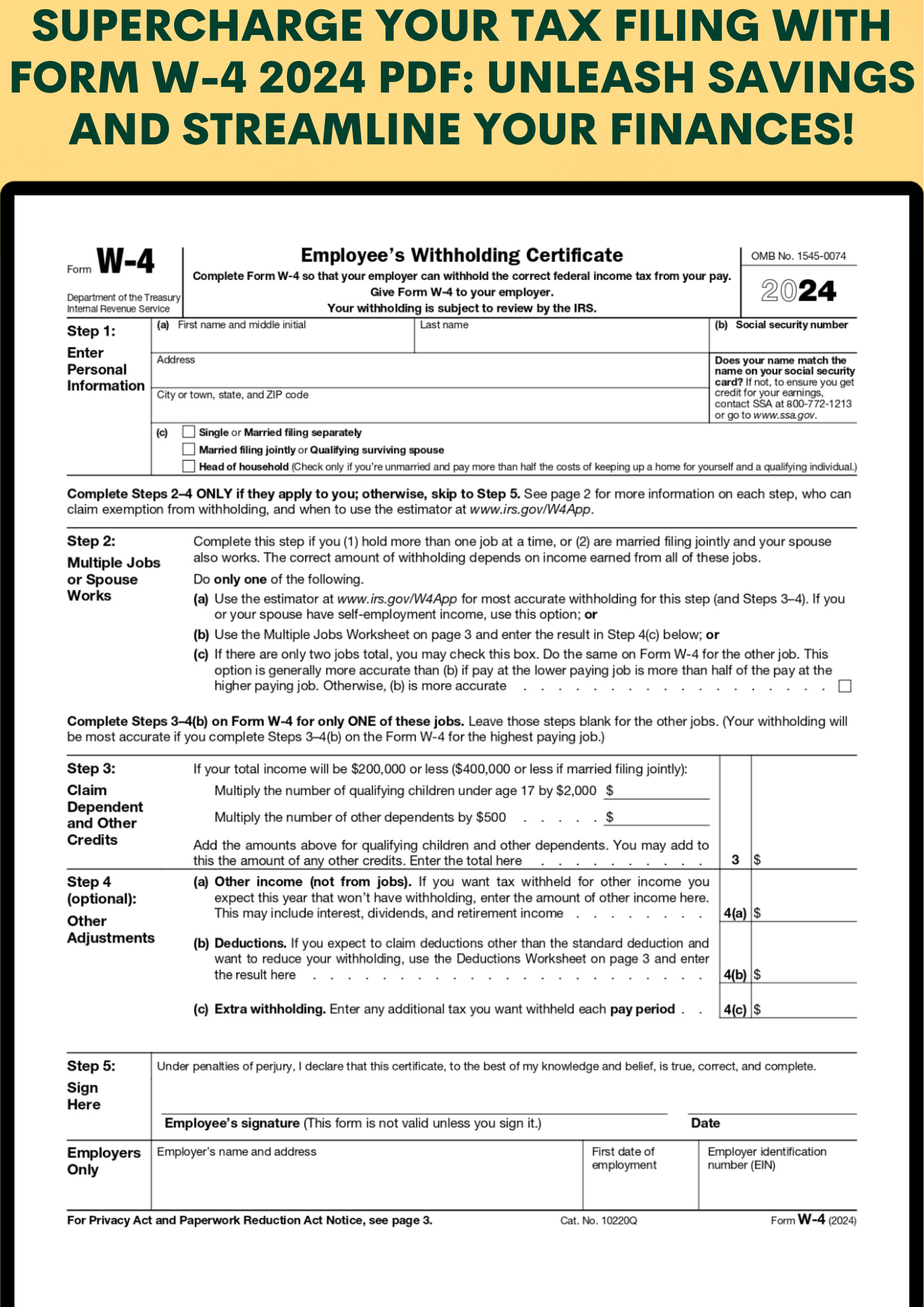

Form W-4 is an essential document that determines the amount of federal income tax to be withheld from your paycheck. It is typically completed by employees and submitted to their employers, ensuring accurate tax withholding throughout the year. The recent updates to Form W-4 for the year 2024 aim to simplify the process and make it more personalized.

By optimizing your Form W-4, you can have greater control over your tax situation and potentially increase your take-home pay. Let’s explore how you can make the most of Form W-4 to supercharge your tax filing process.

1. Update Your Personal Information

Start by carefully reviewing your personal information on Form W-4. Ensure that your name, address, and Social Security number are accurately provided. Any errors or discrepancies could potentially delay your tax filing or result in incorrect tax calculations.

2. Assess Your Filing Status

Your filing status determines the tax brackets and deductions applicable to you. Whether you are single, married filing jointly, married filing separately, or head of household, it is crucial to select the correct status on Form W-4. This will ensure that the appropriate amount of taxes is withheld from your paycheck.

3. Evaluate Your Allowances

Form W-4 allows individuals to claim allowances, which directly impact the amount of tax withheld. Accurately assessing your allowances can help you avoid overpaying or underpaying taxes throughout the year. Take the time to consider your personal circumstances, such as dependents or other deductions, and adjust your allowances accordingly.

4. Consider Additional Withholding

If you have multiple sources of income or anticipate additional income throughout the year, consider requesting additional withholding on Form W-4. This can prevent unexpected tax bills or penalties when filing your taxes. By proactively adjusting your withholding, you can ensure a smoother tax filing process.

5. Seek Professional Advice

While Form W-4 provides a standardized framework, everyone’s tax situation is unique. If you are unsure about the appropriate adjustments to make on your Form W-4, it is advisable to seek professional advice from a tax consultant or accountant. They can guide you through the process, considering your specific financial circumstances and goals.

In conclusion, the updated Form W-4 for the year 2024 offers an opportunity to supercharge your tax filing experience. By understanding and optimizing your Form W-4, you can unleash savings and streamline your finances. Remember to update your personal information, assess your filing status, evaluate your allowances, consider additional withholding, and seek professional advice if needed.

Make the most of the updated Form W-4, maximize your tax savings, and enjoy a stress-free tax season. Start now and take control of your financial future!

Here are W4 Form 2024: