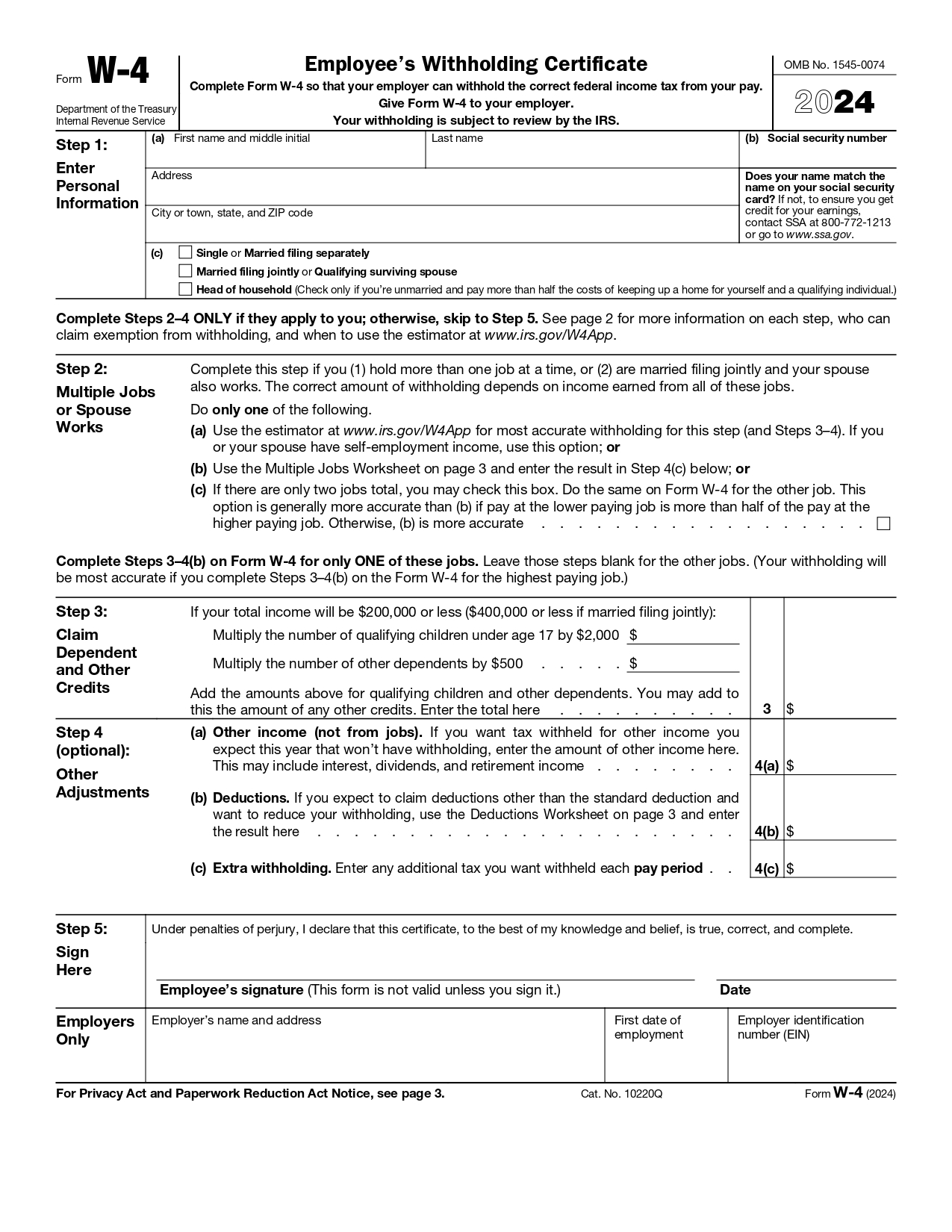

Is There a New W4 Form for 2024?

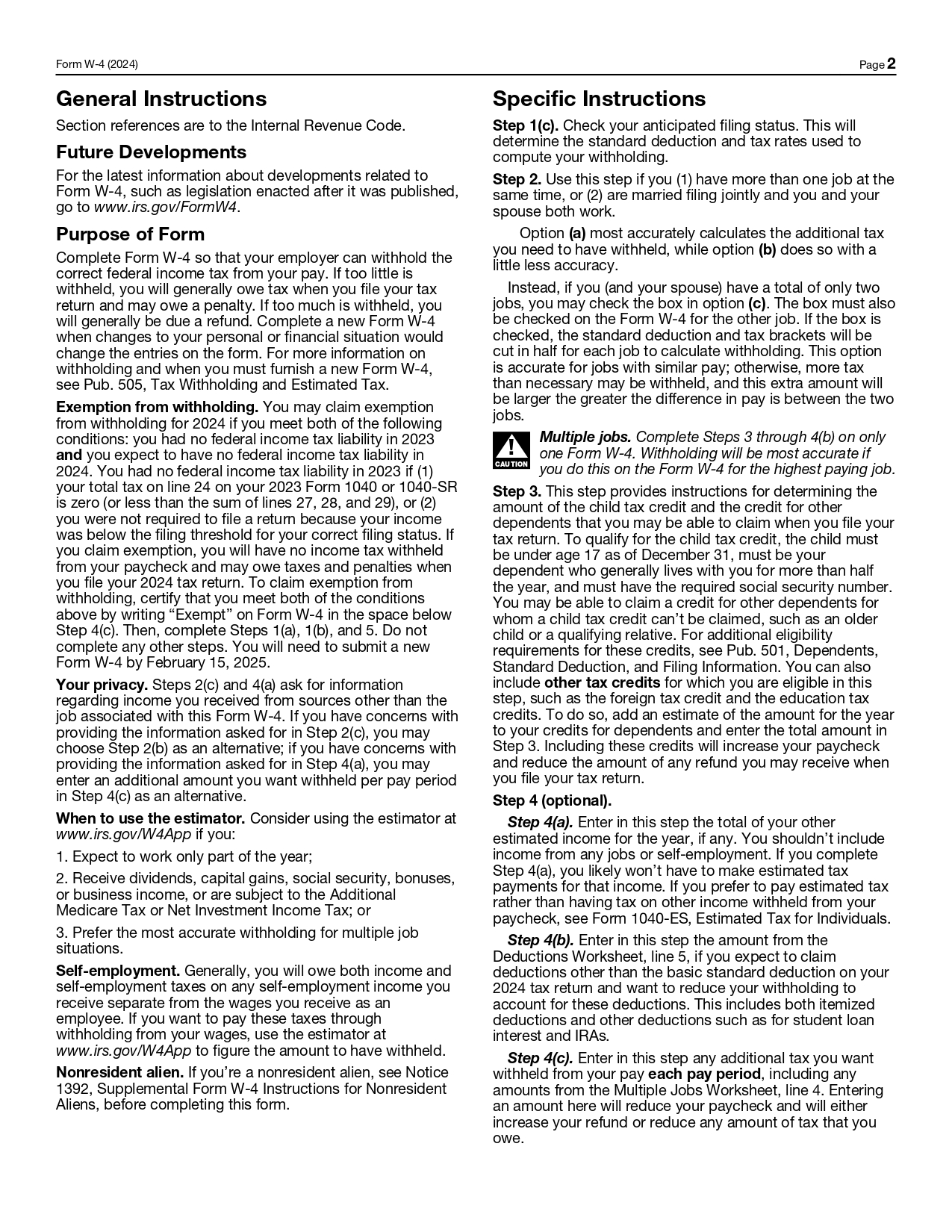

Yes, the Internal Revenue Service (IRS) has released a new W4 Form 2024. This updated W-4 form 2024 reflects changes to enhance the accuracy of tax withholdings for employees. It includes revisions that aim to simplify the process of filling out the form, ensuring that employees’ federal income tax withholdings align more closely with their actual tax liability. This new version is important for both employees and employers to understand and implement, as it impacts how much tax is withheld from paychecks and could affect annual tax returns. For detailed information, employees and employers are encouraged to visit the IRS website and review the updated W-4 form 2024.

The Internal Revenue Service (IRS) has recently released a new W-4 form for the year 2024. The W-4 form, also known as the Employee’s Withholding Certificate, is a crucial document that determines how much federal income tax should be withheld from an employee’s paycheck. With the introduction of the new form, both employees and employers need to understand the changes and how they might affect tax withholdings and returns.

Key Changes in the 2024 W-4 Form

- Simplified Design: The IRS has aimed to make the form more user-friendly. The new design is intended to be more intuitive, allowing taxpayers to more easily understand and accurately complete the form.

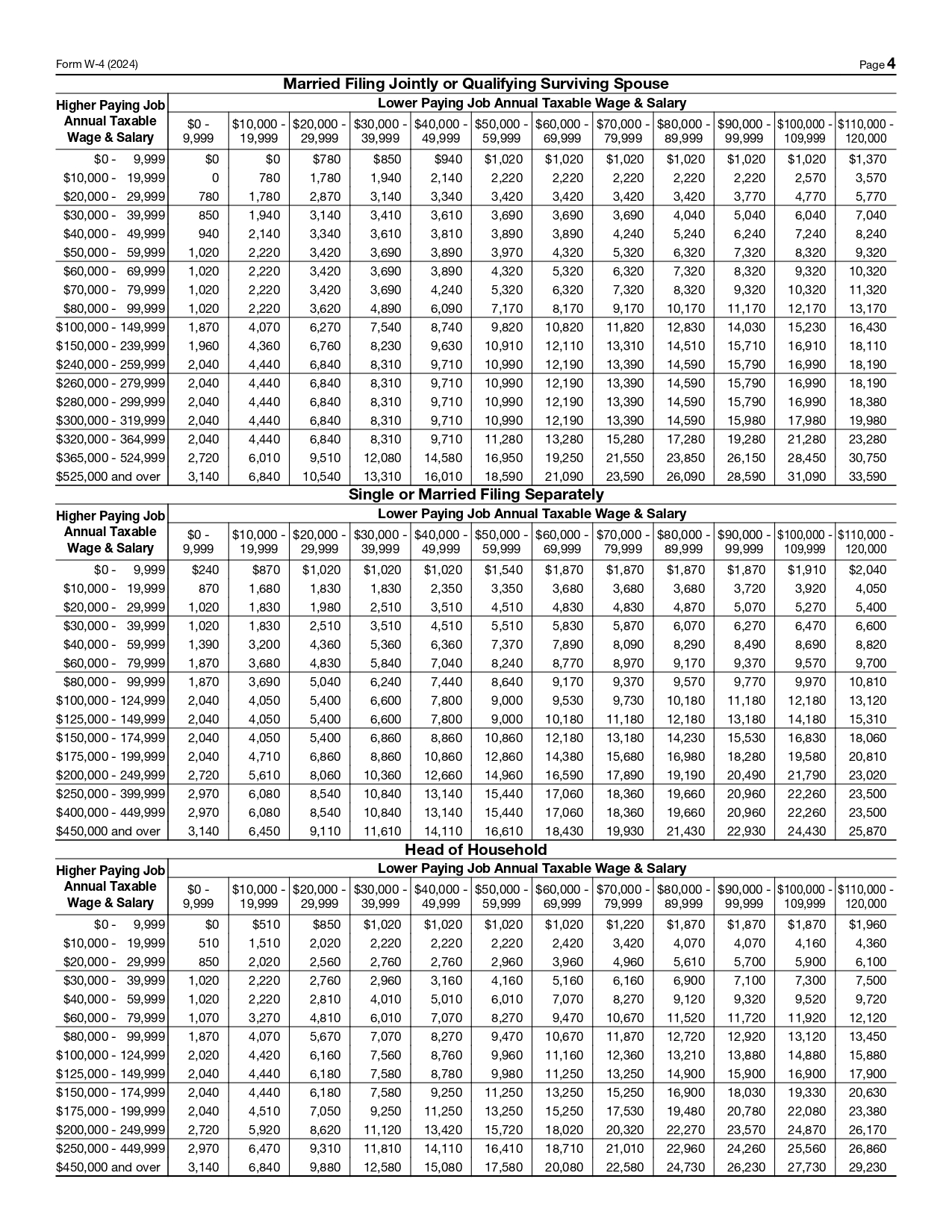

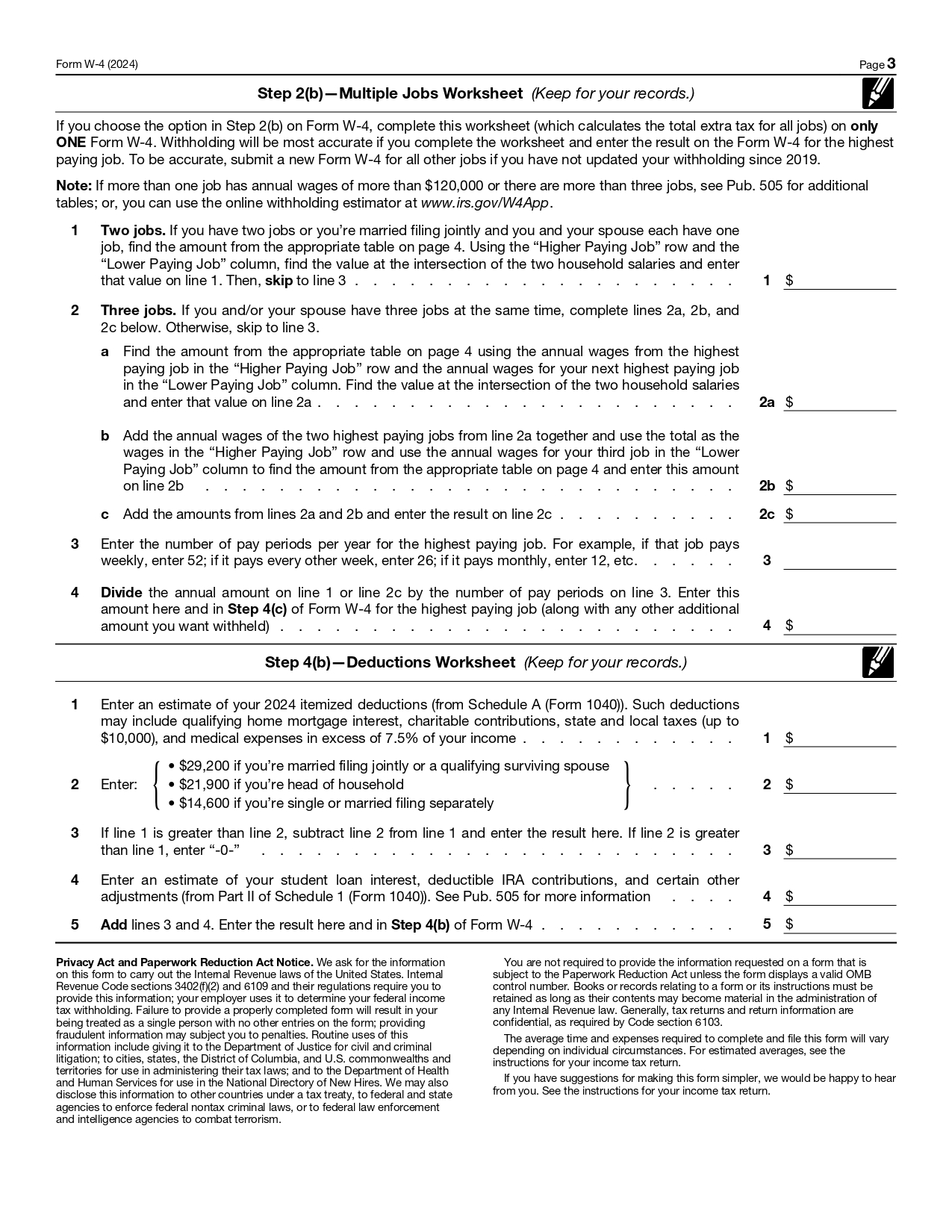

- Adjustments to Tax Withholding Estimations: The 2024 form incorporates changes to better align with the individual tax obligations of employees. This means that the calculations for withholdings have been adjusted to improve accuracy.

- Additional Income Considerations: For those with multiple jobs or other sources of income, the new form provides clearer guidance on how to account for these additional income streams. This is crucial for ensuring that the right amount of tax is withheld, preventing unexpected tax bills or penalties.

- Dependents and Deductions: The form continues to allow for adjustments based on dependents and anticipated tax deductions. This includes considerations for child tax credits and other relevant deductions that can affect an individual’s tax liability.

- Privacy Enhancements: Recognizing the importance of privacy, the IRS has made efforts to increase confidentiality. The new form allows employees to indicate additional income or other tax situations without having to share specific amounts with their employer.

Implications for Employees and Employers

- Employees: It’s important for employees to review the new W4 Form 2024 and update their withholding information if their personal or financial situation has changed. This is particularly important for those who have experienced major life events, such as marriage, the birth of a child, or a change in income.

- Employers: Employers should ensure that they are using the latest version of the W-4 form for new hires. They should also inform their current employees about the new form and encourage them to review their withholdings.

- Payroll Systems: Companies need to update their payroll systems to accommodate the changes in the new W-4 form. This ensures accurate tax withholding calculations and compliance with federal regulations.

The release of the new W-4 form for 2024 is part of the IRS‘s ongoing efforts to simplify the tax withholding process and improve accuracy. Both employees and employers should take the time to understand the changes and update their information as needed. Doing so will help avoid any surprises during tax season and ensure compliance with federal tax laws.

For more detailed information and to view the new form, you can click here: https://w4form2024.tax/

Is There a New W4 Form for 2024?

YES.