The 2024 Form W-4: Simplified Guidelines and Smart Strategies for Tax Planning is a comprehensive guide designed to assist individuals in navigating the complexities of tax planning. In this article, we will present easy-to-understand information and practical tips that will help you maximize your deductions, minimize your tax liability, and make the most of the recently updated Form W-4. Whether you are a seasoned taxpayer or just starting your career, this guide aims to simplify the process and provide you with smart strategies to optimize your tax planning for the year 2024 and beyond.

Related Post:

- 2024 Form W-4: Simplified Guidelines and Smart Strategies for Tax Planning”

- Revolutionary Tax Calculator 2024: Accurate, Efficient, and Empowering!”

- Effortlessly Access W-4 2024 Printable Forms: Simplify Your Taxes with Ease!”

- Boost Your Efficiency with W 4 Form 2024 Printable – Simplify Tax Filing Hassles Now!”

- Maximize Your 2024 Tax Returns with IRS W4 Form Pdf: Unlock Hidden Benefits & Simplify Reporting”

2024 Form W-4: Simplified Guidelines and Smart Strategies for Tax Planning

The Importance of the 2024 Form W-4

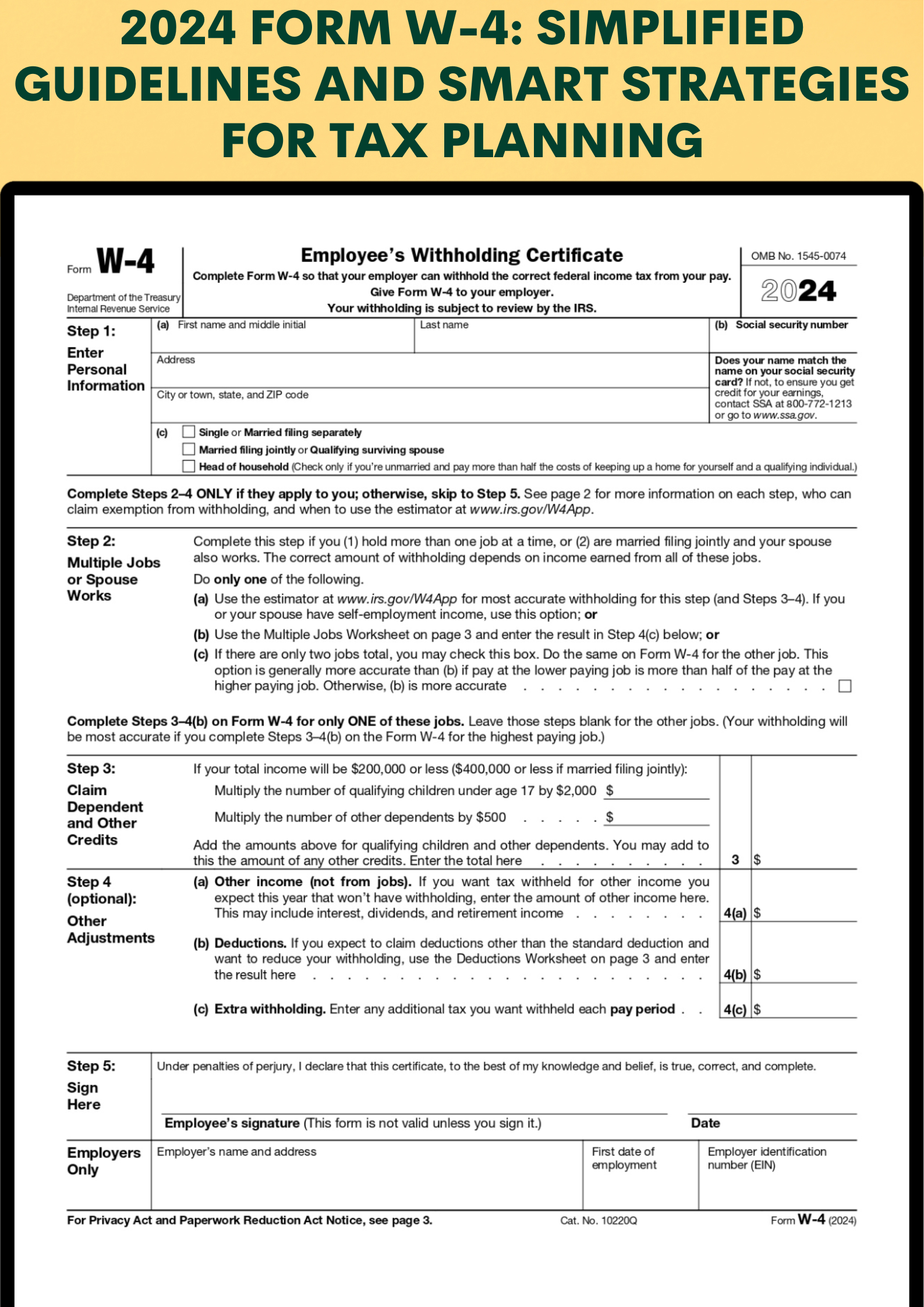

As the year 2024 approaches, taxpayers need to prepare themselves for the changes in tax regulations. One of the most crucial aspects of tax planning is understanding and accurately filling out the Form W-4. The 2024 Form W-4 is designed to provide employees with a simple and efficient way to calculate their tax withholdings. In this article, we will explore the key guidelines and smart strategies for tax planning using the 2024 Form W-4.

What is the 2024 Form W-4?

The 2024 Form W-4 is an essential document that employees must complete when starting a new job or when they experience significant life changes, such as getting married or having a child. This form is used by employers to determine the amount of federal income tax to withhold from employees’ paychecks. It helps ensure that employees’ tax withholdings align with their tax liability, preventing any unpleasant surprises when filing taxes.

Understanding the Changes in the 2024 Form W-4

The 2024 Form W-4 has undergone some modifications compared to its previous versions. The primary goal of these changes is to simplify the form and make it easier for employees to accurately calculate their tax withholdings. It is crucial to understand these changes to optimize your tax planning strategies.

One significant change is the removal of allowances on the 2024 Form W-4. Previously, employees would claim allowances to adjust their withholding amounts. However, the new form eliminates this concept and introduces a more straightforward method.

Instead of allowances, the 2024 Form W-4 includes a step-by-step process to calculate tax withholdings accurately. It considers various factors, such as filing status, multiple jobs, dependents, and other income sources. This shift aims to provide employees with a more precise withholding calculation, reducing the risk of under or overpayment.

Smart Strategies for Tax Planning using the 2024 Form W-4

Now that we understand the importance and changes in the 2024 Form W-4, let’s explore some smart strategies for tax planning:

- Evaluate your filing status: Your filing status plays a crucial role in determining your tax liability. Consider whether you should file as single, married filing jointly, married filing separately, or head of household. Choose the status that best fits your situation to optimize your tax planning.

- Consider multiple jobs: If you have more than one job, it is essential to account for it on the 2024 Form W-4. The form provides a step-by-step process to calculate the additional withholding required for multiple jobs, ensuring that enough taxes are withheld.

- Include dependents: If you have dependents, make sure to include them on the 2024 Form W-4. This will help you qualify for various tax benefits, such as the Child Tax Credit or the Earned Income Credit, reducing your overall tax liability.

- Adjust for other income sources: If you have additional sources of income, such as freelance work or rental property, consider adjusting your withholding on the 2024 Form W-4 accordingly. This will help you avoid underpaying your taxes and potential penalties.

- Regularly review and update: Tax planning is an ongoing process. Make it a habit to review and update your 2024 Form W-4 whenever you experience significant life changes, such as getting married, having a child, or starting a new job. This will ensure that your tax withholdings accurately reflect your current situation.

By following these smart strategies and utilizing the 2024 Form W-4 effectively, you can optimize your tax planning and minimize any potential tax-related issues.

In Conclusion

The 2024 Form W-4 is a critical tool for effective tax planning. Understanding its importance and the changes it brings is essential to ensure accurate tax withholdings. By evaluating your filing status, considering multiple jobs, including dependents, adjusting for other income sources, and regularly reviewing and updating your form, you can make the most of your tax planning efforts. Stay informed, stay proactive, and maximize your tax savings with the 2024 Form W-4!

Here are W4 Form 2024: