Are you looking for a way to simplify your tax process and save money at the same time? Look no further! Introducing the 2024 Tax Forms Printable, designed to maximize your refunds effortlessly. With these printable forms, you can easily navigate through the complex tax system and ensure you’re taking advantage of every deduction and credit available to you. Whether you’re an individual or a small business owner, these forms will simplify the entire process, making it easier than ever to tackle your taxes. Let’s dive into the world of hassle-free tax preparation and start maximizing your refunds today!

Related Post:

- Boost Your Tax Filing Efficiency with Form W-4 2024 PDF: A Comprehensive Guide”

- Printable 2024 Tax Forms: Simplify Filing with Hassle-Free Solutions”

- W4 Calculator 2024: Unlock Your Tax Savings Potential with Ease!”

- 2024 IRS Tax Forms Printable: Simplify Your Filing Process with Easy-to-Access Resources”

- Ultimate Guide to Form W-4 for 2024: Maximize Tax Benefits and Avoid Pitfalls”

Maximize Your Refunds with 2024 Tax Forms Printable: Simplify and Save!

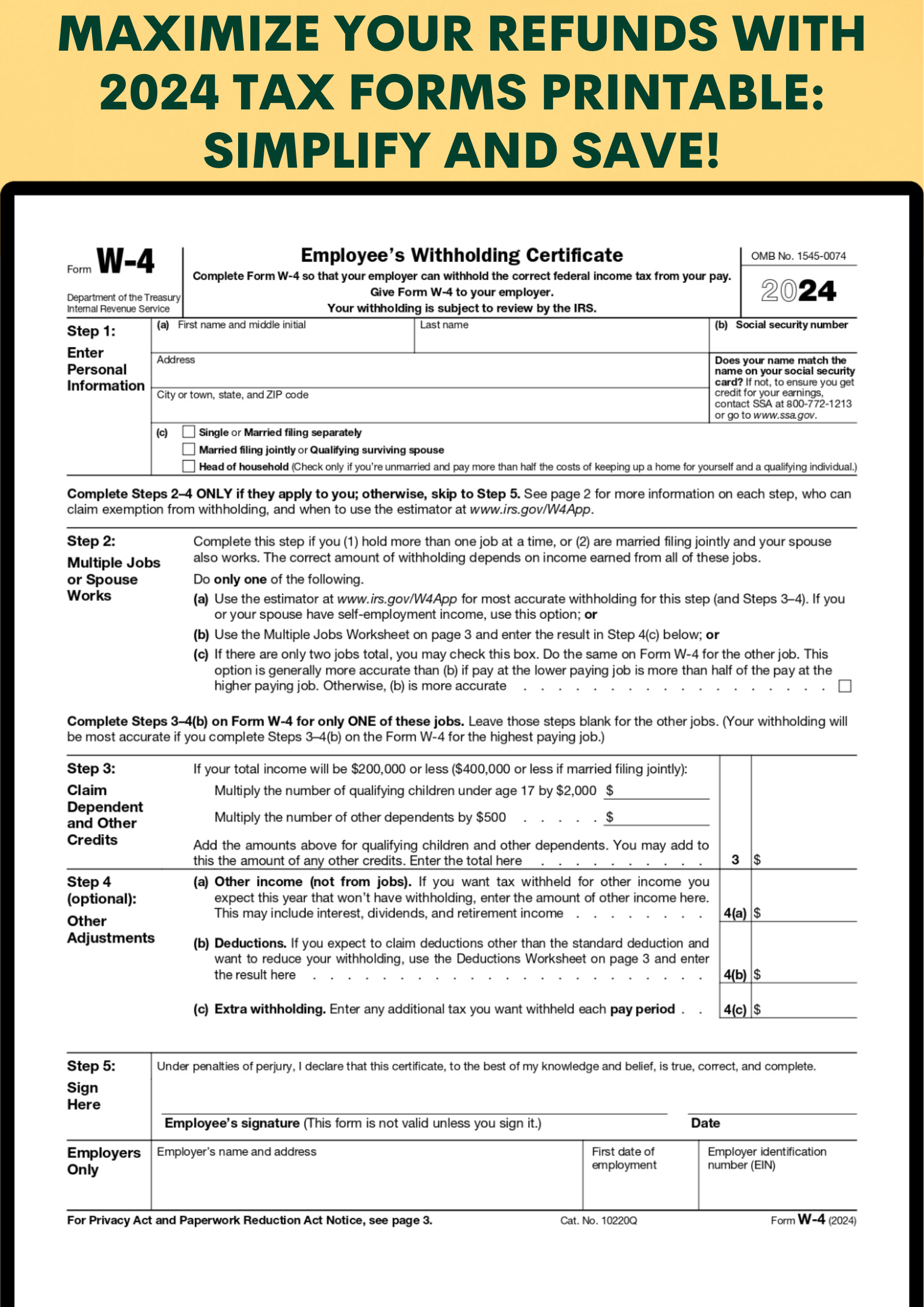

When it comes to filing your taxes, staying organized and having the right forms can make a world of difference. The 2024 tax season is upon us, and it’s time to start thinking about how you can maximize your refunds. One essential form that you need to be familiar with is the W4 form 2024. In this article, we will guide you through the process of using the W4 form to simplify your tax filing and potentially save money. Let’s dive in!

Understanding the W4 Form 2024

The W4 form is an important document that determines the amount of federal income tax withheld from your paycheck. By accurately completing this form, you can ensure that you’re not overpaying or underpaying your taxes throughout the year. This form is especially significant if you’ve experienced life changes such as getting married, having a child, or starting a new job in 2024.

To make the process easier for taxpayers, the IRS releases updated versions of the W4 form each year, including the 2024 version. The latest W4 form includes several changes aimed at simplifying the process and ensuring accuracy.

Benefits of Using the W4 Form 2024

Using the W4 form 2024 can offer a range of benefits for taxpayers. Here are a few key advantages:

- Accurate withholding: By completing the W4 form accurately, you can ensure that the right amount of tax is withheld from your paycheck. This prevents you from owing a large sum when you file your taxes or receiving a small refund.

- Reduced financial stress: Knowing that your taxes are being handled correctly can help alleviate financial stress. By using the W4 form 2024, you can have peace of mind and focus on other important aspects of your life.

- Potential tax savings: By carefully assessing your tax situation and making necessary adjustments on the W4 form, you may be able to increase your take-home pay or receive a larger tax refund, ultimately saving you money.

Steps to Maximize Your Refunds with the W4 Form 2024

Now that you understand the importance and benefits of the W4 form 2024, let’s explore some steps to help you maximize your refunds:

1. Review your current withholding status

Start by reviewing your current withholding status. If you’ve experienced any significant life changes or if it has been a while since you last updated your W4 form, it’s a good idea to reassess your situation. Determine if you need to make any adjustments to your withholding allowances.

2. Estimate your tax liability

Use online tax calculators or consult a tax professional to estimate your tax liability for the year. This will help you determine if you’re on track with your current withholding or if you need to make changes to avoid any surprises during tax season.

3. Complete the W4 form accurately

When completing the W4 form 2024, pay close attention to the instructions provided. Make sure to fill in all the required fields accurately, including your personal information, filing status, and any additional withholding you wish to claim.

4. Consider additional tax credits and deductions

Explore any tax credits or deductions that you may be eligible for. The W4 form allows you to claim these additional amounts, which can further reduce your tax liability and potentially increase your refund.

5. Regularly review and update

Your tax situation may change throughout the year due to various factors. It’s important to review and update your W4 form whenever necessary. By staying proactive, you can ensure that your withholding remains accurate, maximizing your refunds.

Conclusion

By understanding and utilizing the W4 form 2024 effectively, you can simplify your tax filing process and potentially save money. Remember to review your withholding status regularly, estimate your tax liability, and accurately complete the form. Additionally, explore any available tax credits and deductions to maximize your refunds. Stay proactive and update your W4 form whenever necessary to ensure accurate withholding throughout the year. With these steps, you can confidently navigate the 2024 tax season and make the most of your refunds!

Here are W4 Form 2024: