Are you struggling to navigate the complexities of filling out your W4 form? Look no further! In this comprehensive step-by-step guide, we will help you master the art of completing your W4 form perfectly. Whether you’re a new employee or simply need a refresher, our expert advice and easy-to-follow instructions will ensure that you have a firm grasp on this crucial aspect of your financial responsibilities. Say goodbye to confusion and hello to confidence as we demystify the W4 form and empower you to make informed decisions. Get ready to take control of your taxes with our invaluable guidance!

Related Post:

- Ultimate Guide to IRS 2024 W4 Form PDF: Streamline Your Taxes with Efficiency and Confidence”

- Supercharge Your Tax Filing with Form W-4 2024 PDF: Unleash Savings and Streamline Your Finances!”

- Maximize Your Refunds with 2024 Tax Forms Printable: Simplify and Save!”

- Maximize Your Refunds with W4 Calculator 2024: Boost Your Tax Savings Now!”

- 2024 IRS Tax Forms Printable: Simplify Your Filing Process with Convenient Downloads”

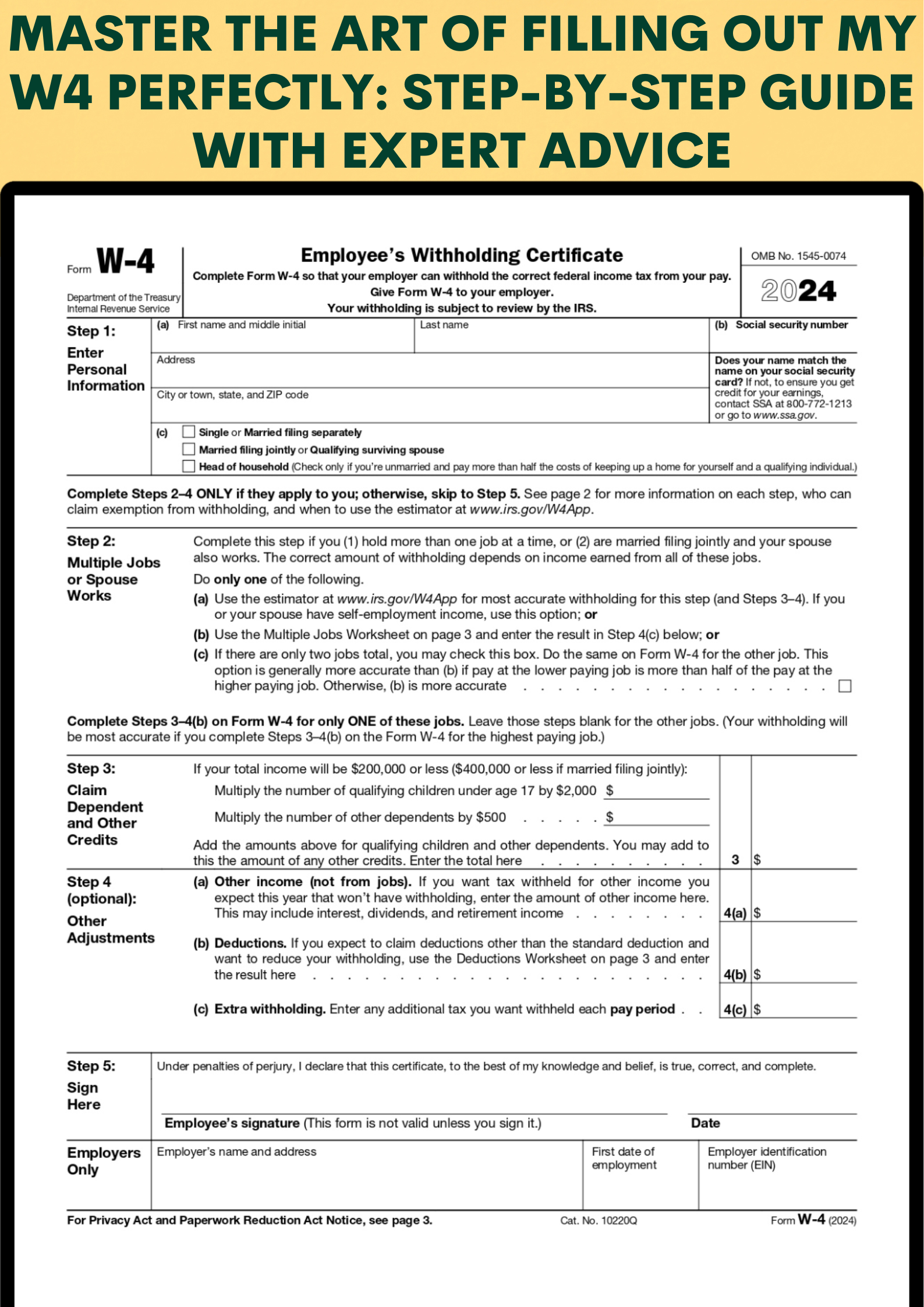

Mastering the art of filling out your W4 form correctly is crucial for ensuring a smooth tax filing process. The W4 form, also known as the Employee’s Withholding Certificate, is a document that helps your employer determine the correct amount of federal income tax to withhold from your paycheck. Filling it out correctly is essential to avoid overpaying or underpaying taxes throughout the year.

Understanding the W4 Form

Before diving into the step-by-step guide, let’s take a moment to understand the W4 form and its significance. The form consists of various sections, including personal information, filing status, allowances, and additional withholding. Each section plays a crucial role in determining the amount of tax withheld from your paycheck.

It’s important to note that the W4 form has recently undergone changes, and the 2024 version brings additional updates. Staying up-to-date with these changes ensures accurate tax withholding. Let’s explore the step-by-step guide to filling out your W4 form perfectly.

Step 1: Personal Information

The first section of the W4 form requires you to provide your personal information, including your name, address, Social Security number, and filing status. Ensure that all the details are accurate and up-to-date, as any errors may lead to problems with your tax withholding.

Step 2: Filing Status

The filing status you choose on your W4 form determines the tax rates applied to your income. There are five options: Single, Married Filing Jointly, Married Filing Separately, Head of Household, and Qualifying Widow(er) with Dependent Child. Select the option that best aligns with your current situation, as it directly impacts your tax liability.

Step 3: Allowances

The allowances section allows you to indicate the number of withholding allowances you wish to claim. Claiming allowances reduces the amount of tax withheld from your paycheck. It’s essential to strike the right balance – claiming too few allowances may result in over-withholding, while claiming too many may lead to under-withholding.

When determining the appropriate number of allowances, consider factors such as your marital status, dependents, and any additional income sources. The IRS provides a worksheet with the W4 form to help you calculate the correct number of allowances based on your specific circumstances.

Step 4: Additional Withholding

If you anticipate owing additional taxes or want to have extra tax withheld from your paycheck, you can specify an additional withholding amount in this section. This can be useful for individuals with multiple sources of income or those who want to ensure they meet their tax obligations throughout the year.

Expert Advice on Filling Out Your W4 Form

While following the step-by-step guide is essential, it’s always beneficial to consider expert advice to optimize your W4 form. Here are some tips from tax professionals:

- Review your W4 form annually or when significant life events occur, such as marriage, divorce, or the birth of a child. These events may impact your filing status and allowances.

- Utilize the IRS withholding calculator to determine the appropriate number of allowances based on your income, deductions, and credits.

- Consider consulting a tax professional if you have complex financial situations, such as self-employment income, investment income, or rental properties.

- Keep a copy of your filled-out W4 form for your records. This will come in handy during tax season or if any discrepancies arise.

- Stay informed about tax law changes, as they may affect your W4 form. The IRS provides regular updates and resources on their official website.

By mastering the art of filling out your W4 form correctly, you can ensure accurate tax withholding and avoid unnecessary financial burdens. Keep in mind the importance of reviewing your W4 form periodically and seeking professional guidance when necessary. With these steps and expert advice, you’ll be well-equipped to navigate the W4 form and maintain your financial well-being.

Here are W4 Form 2024: