In an effort to simplify tax withholding for employees, the Internal Revenue Service (IRS) has made updates to the W-4 form. These annual changes, often surrounded by confusion and uncertainty, have left many individuals seeking clarity. Fortunately, in this article, we will demystify the new W-4 form updates and shed light on the truth behind these modifications. By the end, you will have a better understanding of how these changes affect your paycheck and what steps you need to take to ensure accurate tax withholding. So, let’s dive in and uncover the facts behind the annual W-4 form updates.

Related Post:

- Demystifying the Annual Changes: The Truth about New W-4 Form Updates”

- Master the Art of Filling Out My W4 Perfectly: Step-by-Step Guide with Expert Advice”

- Optimize Your Tax Savings: Unveiling the Pros and Cons of Claiming 1 or 0!”

- Boost Your Efficiency with W-4 2024 Printable: Save Time and Money!”

- Effortless W-4 Form 2024 Printable: Simplify Tax Filing with Ease!”

Demystifying the Annual Changes: The Truth about New W-4 Form Updates

Understanding the Importance of W-4 Form in 2024

The Internal Revenue Service (IRS) has recently introduced updates to the W-4 form for the year 2024, causing confusion and uncertainty among taxpayers. In this article, we aim to demystify these changes and shed light on the truth behind the new W-4 form updates. Understanding the significance of the W-4 form is crucial for taxpayers to ensure accurate tax withholding, avoid penalties, and maintain financial stability.

What is the W-4 form?

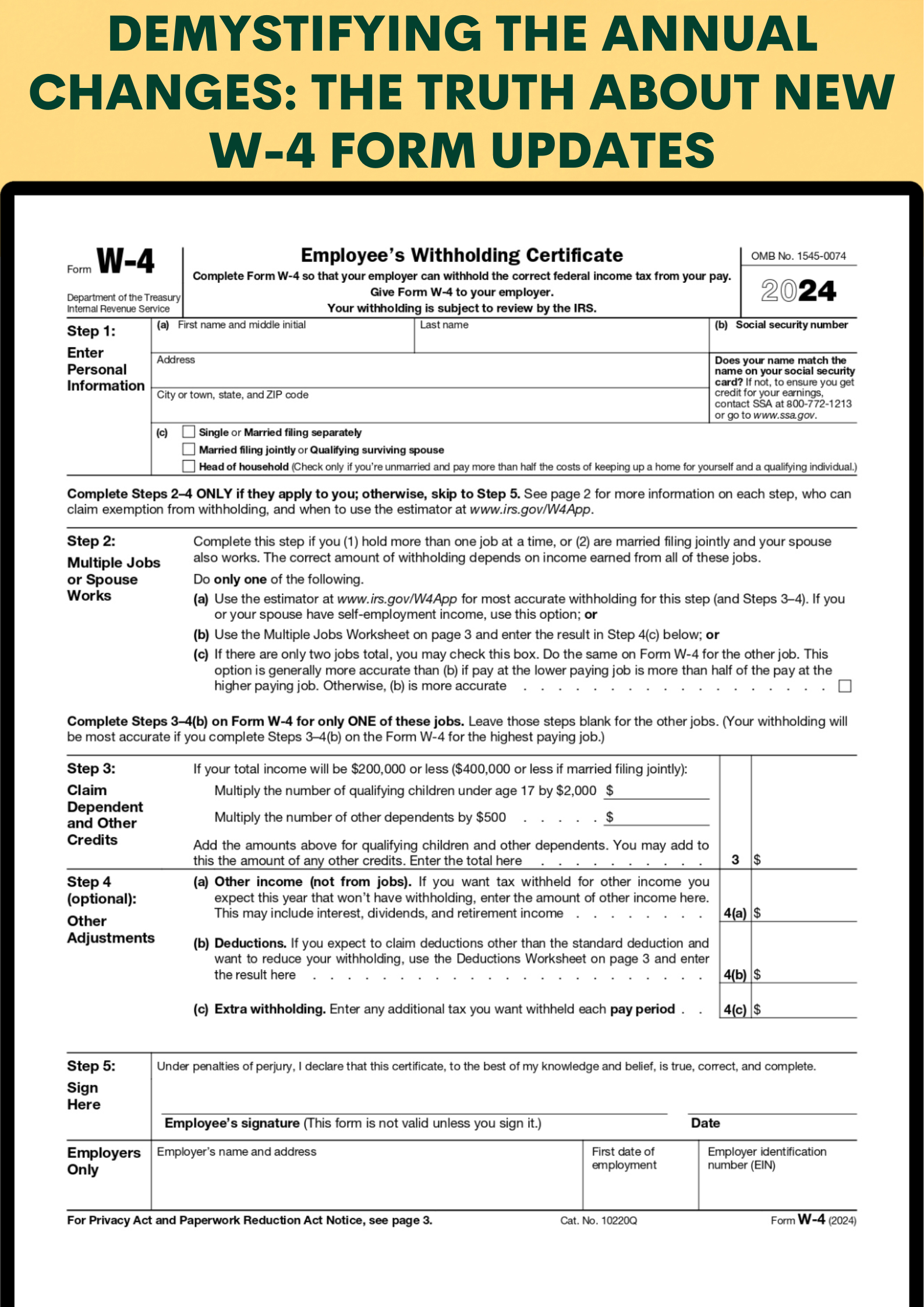

The W-4 form, also known as the Employee’s Withholding Certificate, is a document that employees in the United States fill out to inform their employers about the amount of federal income tax to withhold from their paychecks. This form plays a vital role in determining the correct tax withholding amount, ensuring individuals neither owe a significant amount of taxes nor receive a large refund at the end of the year.

Why are there updates to the W-4 form in 2024?

The IRS periodically updates the W-4 form to reflect changes in tax laws and regulations. The recent updates for 2024 aim to simplify the form and make it more accurate, transparent, and user-friendly. The changes take into account updates to tax brackets, adjustments to the standard deduction, and modifications to tax credits and deductions.

Key Changes in the New W-4 Form

- Elimination of personal allowances: In the previous version of the W-4 form, employees used to claim personal allowances, which were used to calculate the tax withholding amount. However, starting from 2024, personal allowances have been eliminated.

- Introduction of a five-step process: The new W-4 form for 2024 introduces a five-step process that helps employees accurately determine their tax withholding amount. These steps include providing personal information, accounting for multiple jobs, claiming dependents, adjusting for deductions, and including additional income.

- Enhanced accuracy: The updates to the W-4 form aim to improve accuracy by considering various factors that may affect an individual’s tax liability. These factors include other income sources, deductions, and credits.

How to Complete the New W-4 Form

Completing the new W-4 form requires individuals to carefully follow the instructions provided. It is important to accurately fill out each section to ensure the correct tax withholding amount. Employees must consider their personal circumstances, such as the number of dependents, other sources of income, and eligible deductions or credits, while completing the form.

Implications and Benefits of the New W-4 Form

The updates to the W-4 form have several implications and benefits for both employees and employers. By accurately completing the form, employees can ensure the correct amount of taxes is withheld from their paychecks, reducing the risk of owing significant taxes or receiving an excessive refund. This allows individuals to better manage their finances throughout the year.

Employers benefit from the updated W-4 form as well. The new form provides clearer instructions, reducing the chances of errors in tax withholding calculations. This streamlines the payroll process and minimizes the administrative burden on employers.

Conclusion

Understanding the changes in the new W-4 form for 2024 is essential for individuals to navigate the tax system successfully. By demystifying these annual updates, we have shed light on the truth behind the changes, ensuring taxpayers are well-informed and capable of accurately completing the form. Remember, the W-4 form plays a crucial role in determining your tax liability, and it is important to review and update it whenever necessary.

Here are W4 Form 2024: